Nikkei 225 Index Overview

The Nikkei 225, also known as the Nikkei Stock Average, is the leading stock market index in Japan. It is a price-weighted index that tracks the performance of the top 225 companies listed on the Tokyo Stock Exchange’s First Section.

In the bustling streets of Tokyo, where the Nikkei 225 soared to unprecedented heights, there was a hidden world of intrigue and desire. Amidst the towering skyscrapers, the enigmatic Rosabell Laurenti Sellers https://isabellagraysonal.bestiste.com/rosabell-laurenti-sellers/ emerged as a symbol of both power and vulnerability.

Her piercing gaze and alluring presence cast a spell over the city’s elite, leaving an indelible mark on the Nikkei 225’s turbulent history.

The index was first launched in 1950 and has since become a benchmark for the Japanese stock market. It is widely used by investors to track the overall performance of the Japanese economy and to make investment decisions.

The Nikkei 225, a key barometer of Japanese economic health, has been on a rollercoaster ride in recent months. But even amidst the market volatility, one thing has remained constant: the allure of the 2023 Tour de France results.

The world’s most prestigious cycling race has captured the imagination of millions around the globe, providing a much-needed distraction from the ups and downs of the financial markets. And as the Nikkei 225 continues to fluctuate, the Tour de France serves as a reminder that even in uncertain times, there’s always something to celebrate.

Calculation Methodology

The Nikkei 225 is calculated by taking the sum of the share prices of the 225 companies included in the index and dividing by the Nikkei 225 divisor. The divisor is a constant that is adjusted periodically to ensure that the index remains comparable over time.

Amidst the tumultuous Nikkei 225’s ups and downs, whispers of France and Austria’s diplomatic dance reached the trading floor. The Nikkei 225, a barometer of Japanese economic health, had always been sensitive to geopolitical events. The ebb and flow of negotiations between the two European nations sent ripples through the market, reminding traders that the world was an interconnected web.

Factors Influencing the Index, Nikkei 225

The value of the Nikkei 225 is influenced by a number of factors, including:

- The performance of the Japanese economy

- The global economic outlook

- Interest rates

- Currency fluctuations

- Investor sentiment

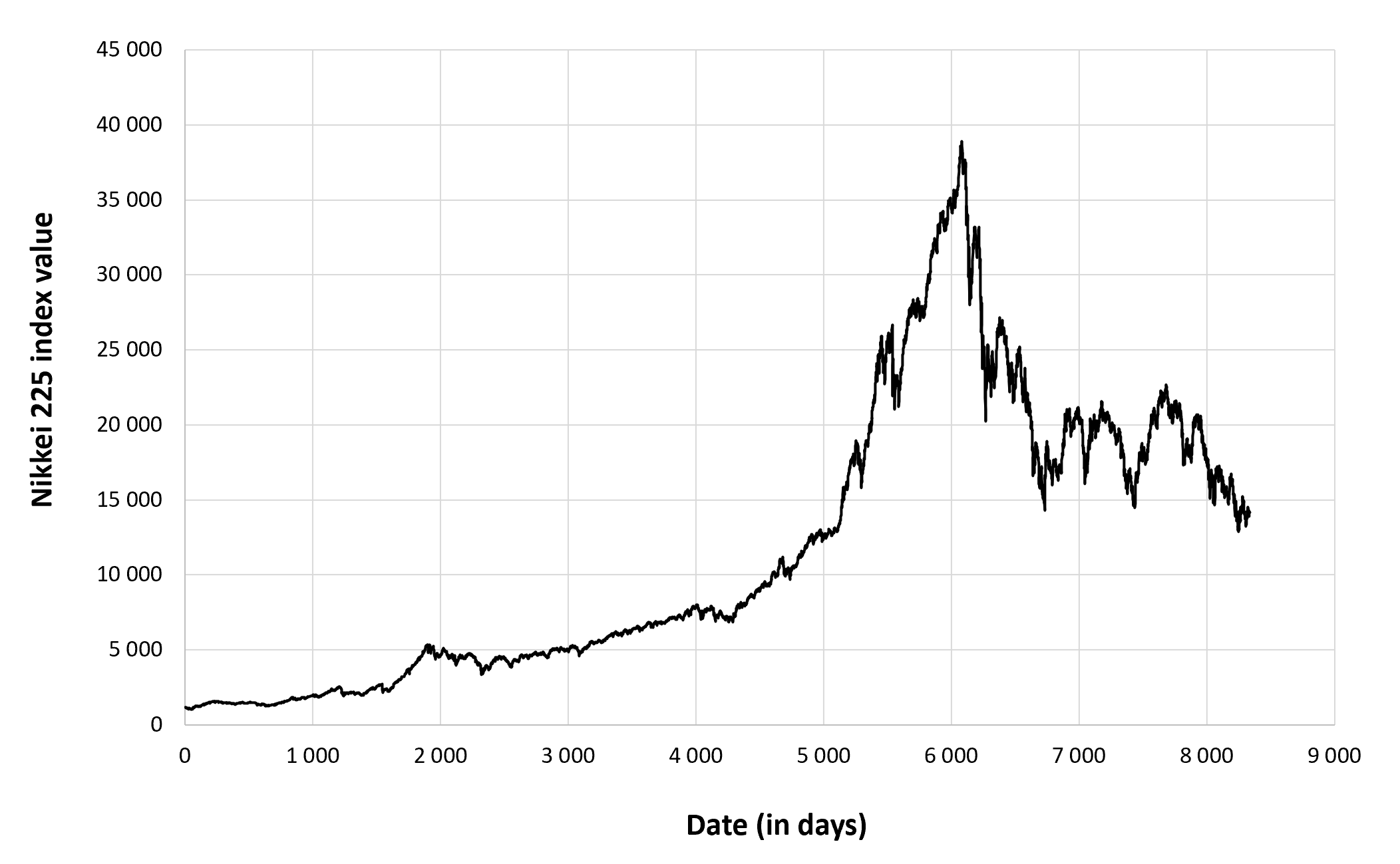

Performance and Correlation

The Nikkei 225 has experienced significant fluctuations over time. It reached a record high of 38,915.87 in December 1989, but then crashed by more than 50% in the early 1990s. The index has since recovered, but it has not yet reached its previous highs.

The Nikkei 225 is correlated with other global stock indices, such as the S&P 500 and the FTSE 100. However, it is also influenced by factors specific to the Japanese economy.

Nikkei 225 Constituents and Sector Analysis

The Nikkei 225 index is composed of 225 of the largest and most actively traded companies in Japan. These companies represent a wide range of industries, including manufacturing, technology, finance, and consumer goods. The index is heavily weighted towards large, well-established companies, with the top 10 constituents accounting for over 50% of its total market capitalization.

The sector composition of the Nikkei 225 index has changed over time, reflecting the evolving Japanese economy. In the past, the index was heavily weighted towards manufacturing companies, but in recent years, the technology and financial sectors have become increasingly important.

Top Constituents

- Toyota Motor Corporation: The world’s largest automaker by production volume.

- Sony Group Corporation: A global technology and entertainment conglomerate.

- Mitsubishi UFJ Financial Group, Inc.: The largest bank in Japan by assets.

- Keyence Corporation: A leading manufacturer of automation and measurement instruments.

- SoftBank Group Corp.: A telecommunications and technology conglomerate.

Sector Composition

The Nikkei 225 index is heavily weighted towards the manufacturing sector, which accounts for over 40% of its total market capitalization. The technology sector is the second largest, accounting for over 20% of the index. The financial sector is the third largest, accounting for over 15% of the index. Other sectors represented in the index include consumer goods, healthcare, and utilities.

Impact of Different Sectors

The performance of the Nikkei 225 index is influenced by a variety of factors, including the performance of its constituent companies and the overall economic environment in Japan. The manufacturing sector is a major driver of the index, and its performance is closely tied to the global economy. The technology sector is also a major driver of the index, and its performance is influenced by factors such as innovation and consumer demand. The financial sector is less volatile than the other sectors, but it can still have a significant impact on the index, especially during periods of financial stress.

Key Industry Trends

The Nikkei 225 index is likely to be affected by several key industry trends in the coming years. These trends include the rise of automation and artificial intelligence, the growth of the Chinese economy, and the increasing importance of environmental sustainability.

Automation and artificial intelligence are expected to have a major impact on the manufacturing sector, leading to increased productivity and efficiency. This could lead to job losses in some sectors, but it could also create new opportunities in other sectors. The growth of the Chinese economy is also expected to have a positive impact on the Nikkei 225 index, as China is a major export market for Japanese companies.

Increasing importance of environmental sustainability is also likely to affect the Nikkei 225 index. Companies that are able to reduce their environmental impact are likely to be more successful in the long term, as consumers and investors become more aware of the importance of sustainability.

Nikkei 225 Trading and Investment Strategies

Trading and investing in the Nikkei 225 index offers a range of opportunities for market participants. Understanding the different trading methods and incorporating technical and fundamental analysis techniques can enhance decision-making and improve trading outcomes.

Trading Methods

Traders can access the Nikkei 225 index through various instruments, including futures, options, and exchange-traded funds (ETFs).

- Futures: Nikkei 225 futures contracts provide leveraged exposure to the index’s performance, allowing traders to speculate on price movements or hedge against market risk.

- Options: Nikkei 225 options offer traders the right but not the obligation to buy or sell the index at a specified price on a future date. Options can be used for hedging, speculation, or income generation.

- ETFs: Nikkei 225 ETFs track the performance of the index, providing investors with a convenient and cost-effective way to gain exposure to the Japanese stock market.

Technical Analysis

Technical analysis involves studying historical price data to identify patterns and trends that can help predict future price movements. Common technical indicators used to trade the Nikkei 225 include:

- Moving averages

- Relative Strength Index (RSI)

- Bollinger Bands

- Ichimoku Kinko Hyo

Fundamental Analysis

Fundamental analysis focuses on the underlying economic and financial factors that influence the performance of the Nikkei 225 index. Investors should consider factors such as:

- Economic growth and interest rates in Japan

- Corporate earnings and dividend payouts

- Political stability and government policies

- Global economic conditions

The Nikkei 225, Japan’s benchmark stock index, had a volatile day on Tuesday, with investors keeping a close eye on the latest developments in the trade war between the US and China. However, all eyes will be on Westeros tonight as the highly anticipated final season of game of thrones tonight airs.

With the fate of the Seven Kingdoms hanging in the balance, it’s sure to be a night of edge-of-your-seat drama. But when the dust settles, investors will be back to focusing on the Nikkei 225 and its implications for the global economy.

The Nikkei 225 index, a barometer of Japanese stock market performance, has been on a steady upward trajectory in recent months. While market analysts ponder the reasons behind this surge, television enthusiasts may be more interested in knowing what time does Game of Thrones air.

Nevertheless, the Nikkei 225’s continued rise is a testament to the resilience of the Japanese economy.